mass tax connect estimated tax payment

Tax professionals can also verify payments online prior to filing a return to minimize delays in processing. MassTaxConnect will replace WebFile for Business later this year and will feature the best of what WFB offers plus state-of-the-art enhancements to make tax account management more efficient less costly and more streamlined than ever.

美國報稅 美國買房與自住房不能錯過的8項稅務優惠 省稅 節稅 Tax Refund Income Tax Brackets Estimated Tax Payments

617 626-2300 or write to us at PO Box 7010 Boston MA 02204.

. The Department of Revenue DOR hasContinue Reading What Are Estimated Taxes and Who Must Pay Them. Use the Massachusetts Adjustments section for Screen 71 2022 Estimates 1040-ES to adjust the estimated tax calculation for Massachusetts. With third party access a tax professional can file and pay estimated taxes for a client.

The new filing system will replace webfile for business. Below are some examples of where you can find payment options. To pay by period.

Tax Department Call DOR Contact Tax Department at 617 887-6367. For more ways to communicate. From the top of the screen select Private Foundation Est.

800 392-6089 toll-free in Massachusetts You may also connect with DOR with MassTaxConnect by email or in person. Estimated payments are due for a taxable year even though the chapter 63D. Enter the amount Applied to beneficiary.

Your support ID is. Enter the Amount paid. Under Quick Links select Make a payment in yellow below.

Complete the information on the next page personal information bank information payment amounts and due dates. The statewide sales tax rate of 625 is among the 20 lowest in the country when including the local taxes collected in many other states. Use this link to log into Mass Department of Revenues site.

Mass Estimated Tax Payments 2021 and the information around it will be available here. Or toll-free in MA 800-392-6089 Child support. 800 392-6089 toll-free in Massachusetts You may also.

If you want to learn more about estimated tax payments in Massachusetts visit the DOR website or call DORs customer service call center at 617 887-6367 or toll-free in Massachusetts at 800 392-6089. Available November 30 2015. MassTaxConnect gives you the option to pay by EFT debit.

Pay your personal income tax Massgov. Individual taxpayers can make bill estimated extension or return payments on MassTaxConnect without logging in. From the left of the screen select Payments Penalties Extensions.

Individuals and businesses can make estimated tax payments electronically through. Please enable JavaScript to view the page content. Tax Department Call DOR Contact Tax Department at 617 887-6367.

See Entering estimated tax on a multi-state individual return for more information. You do no need an account. Form 1-ES is a Massachusetts Individual Income Tax form.

Fiduciary tax payments can also be made on the website but an account with log in information is needed. Contact for Pay your personal income tax. Things are about to get easier and faster for Massachusetts business taxpayers.

For 990-PF or Unrelated Business Est. Pay your personal income tax. Access can be allowed for a specific tax types or for all tax types.

Select individual for making personal income tax payments or quarterly estimated income tax payments. Click on Estimated Tax Payments. Select the Individual payment type radio button.

Visa or MasterCard debit card. Your support ID is. Visa MasterCard or Discover credit card or.

Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 617 887-6367 or 800 392-6089 which is toll-free in Massachusetts. MassTaxConnect provides an instant receipt. Please enable JavaScript to view the page content.

Make estimated tax payments online with masstaxconnect in addition extension return and bill payments can also be made. Select individual for making personal income tax payments or quarterly estimated income tax. You can make your personal income tax payments without logging in.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Or toll-free in MA 800-392-6089 Child support. Individuals with a masstaxconnect login can also make payments by logging in.

For some workers tax season doesnt end on April 19. There are several options for paying your income tax. 9 am-4 pm Monday through Friday.

Freelancers contractors and any professional who doesnt have taxes withheld from paychecks may be required to make an estimated tax payment at the end of each quarter in Massachusetts. ONLINE MASS DOR TAX PAYMENT PROCESS. Users can search and access all recommended login pages for free.

The Massachusetts income tax rate is 500. Scroll down to the Additional Estimated Tax Payments subsection. There is a convenience fee of 235 of your payment amount charged by the third party that provides this service.

From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. Learn which is best for you.

Open link httpsmtcdorstatemausmtc_ From this page click on the Make a Payment tab then youll be prompted to log in to your account. For some workers tax season doesnt end on April 19. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Make a payment with MassTaxConnect Learn about estimated tax payments. Organizing your financial records and setting payment reminders can help you stay on top of your estimated tax obligations for years to come.

Contact for Pay your personal income tax. From the MassTaxConnect homepage select the Make a Payment hyperlink in the Quick Links section. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

DORs customer service call center hours for tax help are 9 am - 5 pm Monday through Friday. Make estimated payments and immediately confirm that DOR has. You can make your personal income tax payments without logging in.

You may pay with your. Make estimated payments and immediately confirm that DOR has received your payment. Estimated tax payments.

Enter the taxpayers name.

Mobile Concept Tax Prep For The Modern Worker Tax Prep Mobile App Design App Design

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Massachusetts State 2022 Taxes Forbes Advisor

Tax Guide For Pass Through Entities Mass Gov

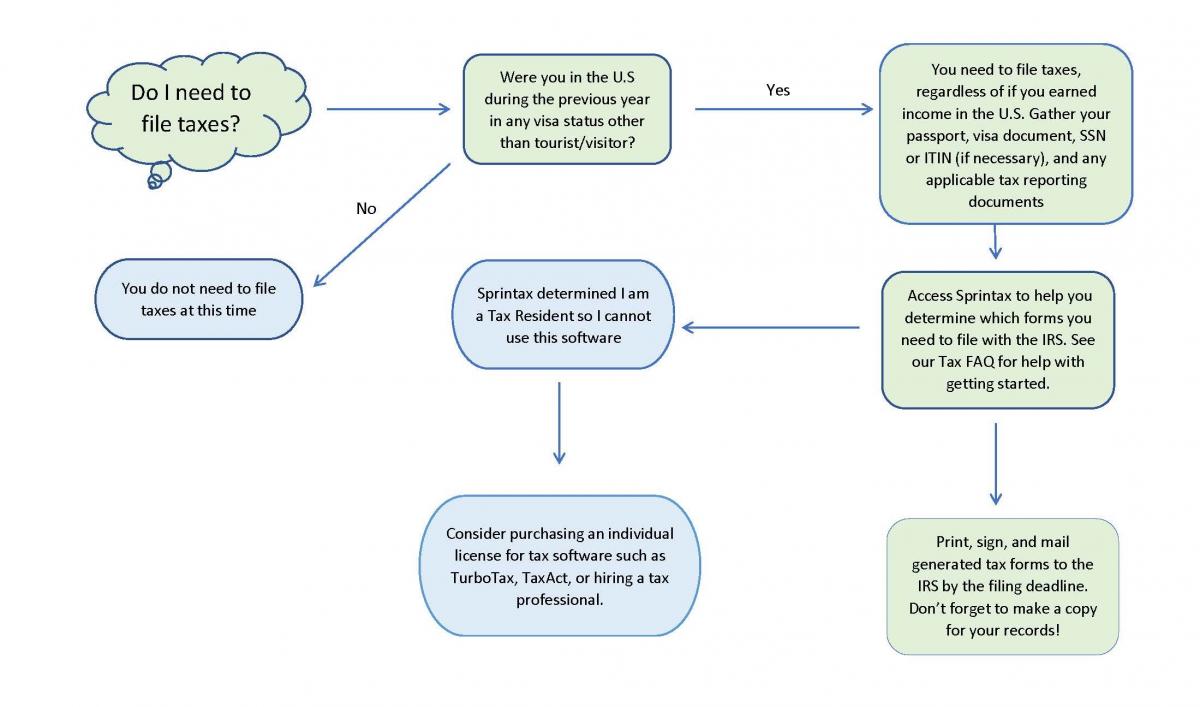

Faq For Tax Filing Harvard International Office

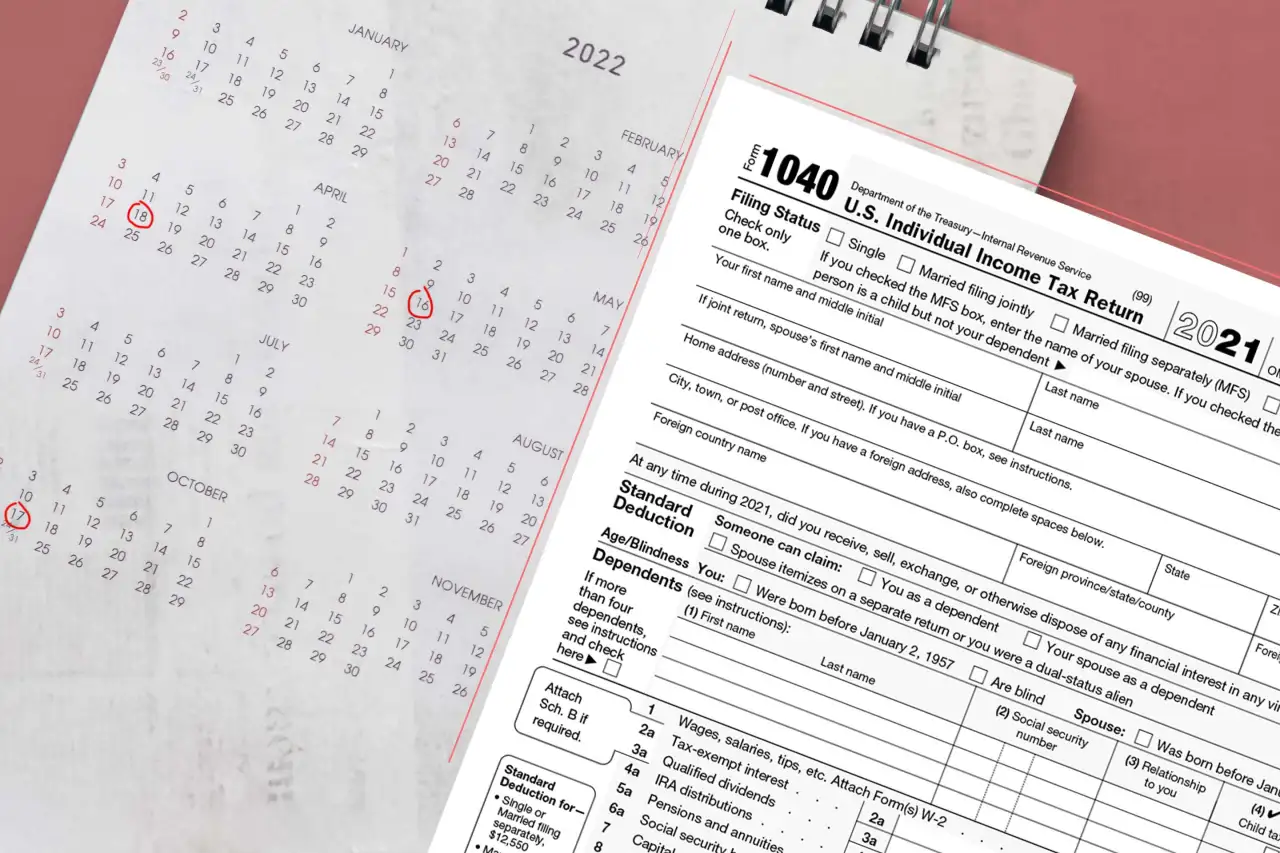

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Massachusetts Income Tax H R Block

Sales And Use Tax For Businesses Mass Gov

Bride Winter January Made Design Websites Branding Graphic Design Inspiration Branding Logo Design Inspiration Creative Logo Inspiration Branding

Prepare And E File Your 2021 2022 Ma Income Tax Return

Advance Payment Requirements Mass Gov

A Guide To Estate Taxes Mass Gov